Put this fast-growing trend to work for your college savings.

Last year ScholarShare 529 beneficiaries received 92,777 gifts of college through the plan’s online giving platform, ugift® ̶ ̶ a figure that has more than tripled since 2020.1

If current trends continue, and there is every reason to believe they will, that figure will far surpass 100,000 ugifts in 2024.

If you’re not using ugift you might want to consider hopping on the bandwagon. To help you with that decision, let’s look at:

- What is ugift

- Why has it become so popular

- What to say to your friends and family

- How to get started with ugift

What is ugift?

Ugift is the ScholarShare 529 online giving platform. It’s really simple ̶ you get a link from the ScholarShare website and whomever you give it to can deposit money directly into your ScholarShare 529 account. No checks to write, cash, or mail. It’s just that simple.

Why has it become so popular?

Because it really is that easy.

Because everyone from new parents to grandparents is interested in using it. In a recent survey of California college savers conducted on behalf of ScholarShare 529, 80% of college savers said they were interested in using ugift.

Don’t assume the Boomers in your life won’t give these two thumbs up ̶ in the survey ugift was just as popular with grandparents as new parents.2

And because friends and family helping with expenses has become the new normal. People crowdfund vacations, and weddings, there are even websites devoted to helping people to crowdfund their birthday presents.

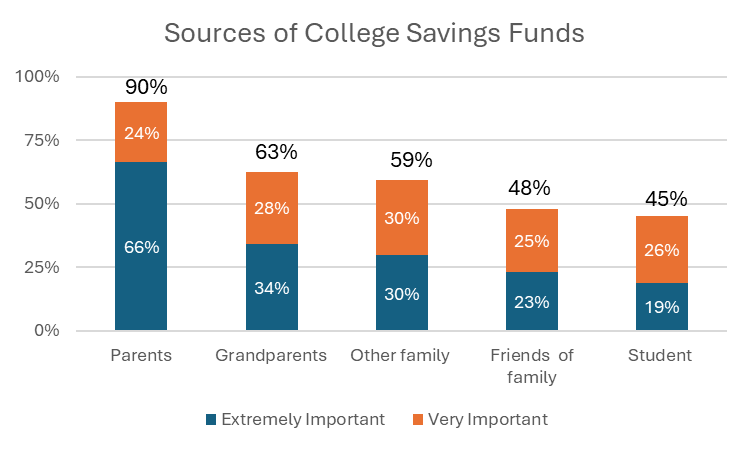

College savings is no exception. In our survey (see chart) a majority of families said grandparents and other family members were an important source of college savings ̶ and 48% said family friends were as well.2 In other words, most people are already taking an “It takes a village” approach to college savings.

What to say to your friends and family

I know, it can feel awkward asking people for money rather than a gift. Here’s an idea for making it easier.

I do a lot of work with non-profits and one thing I see there all the time is if you’re asking for money, the more specific you are about what their gift will be used for, the better. People like knowing the details rather than it being a drop in the bucket for some giant project.

I’d apply the same logic here. Ask friends and family to put money in your child’s ScholarShare 529 account to cover something specific once they get to college… the textbooks for one class, lunch for a month on their meal plan, or a week’s rent for their dorm room.

It makes the whole process warmer and more personal. For example:

Dear Aunt Linda, thank you for putting enough money in my college savings account to cover the textbooks for my first college writing class. What a thoughtful birthday present. You know how much I want to be a journalist and when I start college in three years, I will think of you whenever I use the textbooks you funded.

Of course, these wouldn’t be literal earmarks that live up to accounting standards the way non-profits must. In this case, it’s the thought that counts.

To make it easier for you here’s a list of some common college expenses that you can fund with your ScholarShare 529 account and around how much they currently cost. You can personalize them however you’d like and make them into a wish list for your child’s next birthday or the holidays.

- Textbooks for one class: $1051

- A month of lunches on a typical college meal plan: $150

- One week dorm housing: $211

- One hour of class time: $113

- Lab/materials fees for one class: $50

- Student programming and activities fee for one semester: $38

- A new laptop: $5792

All of these examples can count as qualified higher education expenses you can fund with your ScholarShare 529 savings.4

How to get started with ugift

Just go to the ScholarShare 529 website and watch the video. It explains it all in about 1 minute.

One last thought

We tell our kids all the time never to do something just because everyone else does it, but this is an exception. And if your friends aren’t doing it, you can be the trendsetter.

Sources/ Footnotes:

- Ugift® is a registered service mark of Ascensus Broker Dealer Services, LLC. Source: Company records as of 12/31/2024

- ScholarShare 2023 Market Study among 868 panelists and 1633 account owners

- Calculated from data provided by Education Data Initiative https://educationdata.org/. Last updated November 3, 2023, and UCLA Registrar’s Office information https://registrar.ucla.edu/fees-residence. Actual expenses vary considerably. Do not rely on these figures for budgeting or planning.

- https://www.nytimes.com/wirecutter/reviews/best-laptops-for-college-students/

Consult your legal or tax professional for tax advice. If the funds aren’t used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply. FGN-3455996PR-Y0324W